Politics

Congressman Pledges To Be A ‘Real Pest’ Until Senate Passes His Marijuana Banking Bill

Rep. Ed Perlmutter (D-CO) says that he intends to continue to put significant pressure on his Senate colleagues to advance a bill protecting banks that work with state-legal marijuana businesses as he prepares for retirement from Congress.

Speaking at an event hosted by the American Bankers Association (ABA) on Tuesday, the sponsor of the Secure and Fair Enforcement (SAFE) Banking Act was pressed on the measure’s prospects after it’s cleared the House six times now in some form without any action in the Senate under either Republican or Democratic control.

“I will continue to be a real pest, and persistent in getting this done,” Perlmutter told ABA executive vice president for congressional relations and political affairs James Ballantine, stressing the public safety concerns that have emerged like robberies of state-legal marijuana retailers who are currently forced to operate on a largely cash-only basis.

The money from cannabis businesses and its employees belongs in the bank.

Let's get it there.

Let's pass #SAFEBanking. https://t.co/FKo2yJUXX3

— Rep. Ed Perlmutter (@RepPerlmutter) March 9, 2022

It’s not just your run-of-the-mill robberies that the cash-intensive industry faces, either, Perlmutter said. He referenced instances where police have allegedly targeted armored cars “filled with cash from medical dispensaries” and seized the dollars, which “seemed to [have] a little bit of help by the federal government—FBI in one instance, the DEA and another—even though was all perfectly legal at the time.”

The congressman took the ABA official through the timeline of the SAFE Banking Act and how the notion of such cannabis reform was first laughed off by his colleagues years ago. But as the issue gained momentum, he’s faced different obstacles. With the GOP in control of the Senate last session, key lawmakers blocked hearings because they felt it was too broad; with Democrats now in control, they tell him it’s too narrow.

—

Marijuana Moment is already tracking more than 1,000 cannabis, psychedelics and drug policy bills in state legislatures and Congress this year. Patreon supporters pledging at least $25/month get access to our interactive maps, charts and hearing calendar so they don’t miss any developments.

![]()

Learn more about our marijuana bill tracker and become a supporter on Patreon to get access.

—

Following the bipartisan House passage of the banking bill, Perlmutter said he naively expected it “to sail through the Senate, which is always a bad assumption, because nothing sails through the Senate.”

But he’s taken pains to build support, including from current Senate leadership that has insisted on enacting comprehensive legalization with firm equity provisions in place before advancing a bill viewed as friendly to the industry.

Despite recently saying that he’s “confident” that the Senate will take up his bill this session, the congressman recognized that while he’s supportive of revisions related to criminal justice reform, taxation, research and other issues, he knows that “as we expand this thing, then we start losing votes, particularly Republican votes and we got enough votes in the Senate to do it” as is.

Perlmutter also brought up the fact that Treasury Secretary Janet Yellen has addressed the federal-state marijuana banking conflict and “she wants to get this off her plate and get it done.”

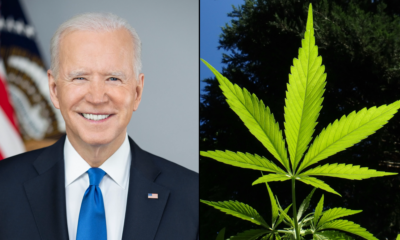

But President Joe Biden and his administration have been “a little bit leery and cautious on this subject.” While the president campaigned on modest cannabis reforms such expungements and rescheduling (promises that have yet gone unfulfilled), he’s not specifically weighed in on the banking issue.

“But with respect to being able to normalize, in effect, banking relationships for the dispensary, for the grower, for the shop and owner, for the accountant, for the lawyer who represents the marijuana business or the related business or the bank, I think we’re in good shape on that,” the congressman said.

Ahead of the ABA event, the financial group released a poll that it commissioned showing that a strong majority of Americans support freeing up banks to work with marijuana businesses without facing federal penalties.

Meanwhile, the number of banks that report working with marijuana businesses ticked up again near the end of 2021, according to recently released federal data.

It’s not clear if the increase is related to congressional moves to pass a bipartisan cannabis banking reform bill, but the figures from the Financial Crimes Enforcement Network (FinCEN) signal that financial institutions continue to feel more comfortable servicing businesses in state-legal markets.

Some Republicans are scratching their heads about how Democrats have so far failed to pass the modest banking reform with majorities in both chambers and control of the White House, too. For example, Rep. Rand Paul (R-KY) criticized his Democratic colleagues over the issue in December.

In the interim, federal financial regulator Rodney Hood—a board member and former chairman of the federal National Credit Union Administration (NCUA)—recently said that marijuana legalization is not a question of “if” but “when,” and he’s again offering advice on how to navigate the federal-state conflict that has left many banks reluctant to work with cannabis businesses.

Oklahoma House Passes Psilocybin Decriminalization And Research Bill, Sending It To Senate